In recent years, #digitalisation has been the talk of the town as financial services firms seek to differentiate themselves and meet evolving customer demands. Traditional financial institutions also find themselves competing with Fintech players that offer full-fledged #digital #banking services. In this article, we would be reviewing the value proposition of digital banks and challenges ahead for them.

Recently, the digital banking industry in Singapore has seen an influx of interest due to the attractive incentives offered by digital banks. Nonetheless, there remains skepticism surrounding the potential profitability of this business model and the adoption rate of digital banking services. Here, we evaluate the value of full digital banks, review associated trends, and examine potential factors that could affect the uptake of digital banking in Singapore. To shed light on the above issues, we will delve into the value proposition of full digital banks in Singapore and examine some potential factors that may affect the adoption rate of digital banks in Singapore.

Background: Context

In 2020, the Monetary Authority of Singapore (MAS) demonstrated its commitment to making Singapore into a world-leading financial centre by granting 2 digital full bank licences and two digital wholesale bank licences. This opening of the digital banking sector marks an important step in providing customers with increased choice in financial services and lowering the barrier of entry for greater innovation and competition in the financial sector. Unlike traditional banks, digital banks do not have any physical branches thus all banking activities are carried out online. This move is important because it allows customers to access a broader range of banking services, with the potential for increased access to credit, payments, and other services enabled by the growth of digital banking technology. Digital banks can be broken down into 2 primary categories, digital full banks and digital wholesale banks (refer to Figure 1).

Digital full banks are online platforms built from the ground up to compete with traditional retail banks. They deliver the same range of banking services as traditional banks but with a stronger focus on customer experience and digital infrastructure. These banks offer the full spectrum of services, from savings, current accounts, lending and payments for both retail and corporate banking. They are focused on creating an easy-to-use customer experience that is tailored to the digital world.

Digital wholesale banks, on the other hand, do not serve retail customers. Instead, they focus on providing banking services to non-retail customers, such as small and medium-sized businesses (SMEs). They provide services such as commercial lending, trade finance, transaction banking, merchant transactional services, and more. These banks are often part of larger organizations that provide financial services for a wide range of customers, including the business sector. They have become popular for clients who need more complex banking services and look to access these through an online platform.

Type | Digital Full Bank | Digital Wholesale Bank |

Target Group | Serves both retail and non-retail customers | Only caters to the SME and other non-retail customers |

Notable Digital Banks |

|

|

*Sign-ups are by invitation-only

Figure 1: Notable Full-fledged Digital Banks in Singapore

As Singapore embraces the rise of digital-only banks to ride the growing wave of digitalisation in the overall economy, we observed great interest from local and global firms when MAS called for applicants.These four awardees were selected from a pool of 14 applicants after a rigorous selection programme.

Two pioneering super apps from the region, Grab and Sea Limited, the company behind the Shopee e-commerce platform, have recently launched their digital banks in Singapore – GxS and Maribank respectively – marking a major milestone in the region’s shift to a new era of digital banking. Built on the existing trust already found within the company’s expansive consumer bases, it’s no surprise that these heavyweights of the region are starting to expand their reach into financial services. With such a captive audience to leverage off, GxS and Maribank have a clear advantage over competitors in terms of acquiring banking customers from the start.

A year on, some of these banks have already started to launch their operations and acquire customers aggressively through various marketing strategies. In March of 2023, digital banking services from Maribank launched with an exclusive invitation structure, introducing the newest digital bank in the country two years after the Monetary Authority of Singapore issued four new licenses. Just two months later, GXS extended its array of financial services with the launch of its consumer loan market, driving new excitement and excitement within the digital banking sector.

Why they may be more attractive than banks

With intense competition for acquiring customers, digital banks have been increasingly aggressive in their marketing campaigns.

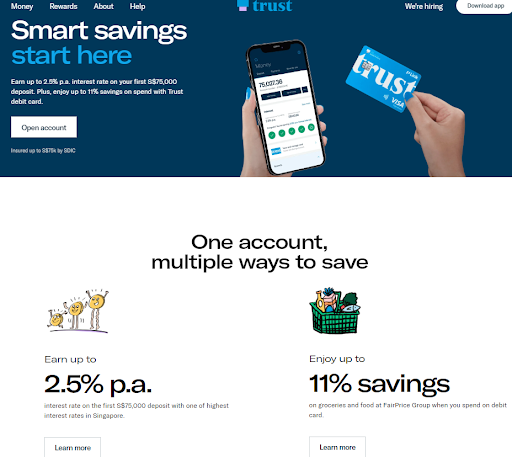

Trust Bank, for example, launched by Standard Chartered and Fairprice Group on 1 September 2022, has been especially proactive in its customer acquisition drives. As part of its customer-acquisition strategy, it offers one of the highest interest rates in Singapore at 2.5% p.a. with no minimum account balance requirement. Trust Bank also integrates into the Fairprice Group’s ecosystem, allowing customers to earn rewards on their grocery and food spend when they transact using Trust Bank accounts at NTUC Fairprice, Kopitiam, Cheers and Unity outlets. Over the first month, the bank handed out impressive rewards worth $42 to all new sign-ups, including $35 worth of FairPrice e-voucher, free 1 Kg Superior Fragrant Rice and a Free KopitiamSignature Breakfast Set. This successful marketing gimmick allowed Trust Bank to acquire an impressive 100,000 newly registered customers aged 18 to 90 within 10 days of its launch.

Despite this impressive feat, some are concerned about the sustainability of such a heavily incentivised business model, as Singapore already has a small unbanked population of 2%. It remains to be seen whether digital banks can go beyond offering discounts and rewards if they want to compete with traditional banks. As it stands, there are still several hurdles that digital banks have to overcome before they become a mainstream option.

Why people may still prefer traditional banks over digital banks

- Banks’ Digitalisation Efforts Are Equally Strong

Singapore’s leading banks have made strong efforts to ensure their digital banking offerings remain competitive in the age of digitisation. DBS Bank was recognised as the “World’s Best Bank” of 2022 by Global Finance and has been the subject of digital transformation studies from world-renowned business schools such as Harvard and INSEAD. These established banks boast mobile applications like DBS PayLah!, which offer a suite of lifestyle features to its 2 million users for activities such as ticket-booking, ride-hailing and tracking card reward points. This puts full-fledged digital banks in a difficult position as they must compete against formidable incumbents, proving a challenging path to profitability.

- Incumbent Banks offers a wide variety of products for different needs

Incumbent banks remain the preferred banking option for consumers due to their immense variety of financial products available. In contrast, digital banks such as Trust Bank may begin by only offering simpler core products – Savings Accounts, Credit Cards, and Insurance. While Trust Bank offers attractive savings account features such as fee waivers and grocery savings, traditional banks offer a much greater range of products such as foreign currency accounts, timed deposit accounts, and Child Development Accounts in conjunction with the Singapore government’s Baby Bonus Scheme.

This variety of products is integral to the profitability of a bank, and the increased competition from traditional banks coupled with the limited profitability of digital banks may detrimentally affect their ability to innovate and introduce new products to appeal to consumers.

It is clear that while digital banks offer excellent savings account features, to compete with incumbents they must think of ways to diversify their revenue streams and innovate, rather than attempting to differentiate themselves solely through rewards and fee waivers that may not be sustainable in the long-term.

- Incumbent Banks’ customer experience journey fosters greater trust with customers, especially older ones.

While digital-only offerings are key highlights of digital banks, they may also pose some challenges when it comes to encouraging adoption. This particular barrier to adoption may be especially relevant to the elderly in Singapore. As digital technology evolves, elderly may struggle to keep up with it. As seniors generally lack familiarity with technology compared to the younger generation, they may be deterred from using services offered by digital-only banks. As mentioned previously, digital banks do not have physical branches and should customers require assistance, it is mainly through virtual means. Although traditional banks focus on digitalisation, they still have many branches in different parts of Singapore. These branches are strategically located and can be found in shopping malls and neighbourhoods. When in need of assistance, customers can simply walk into any of the branches and consult the physical staff there. These face-to-face interactions can translate into greater trust between customers, especially elderly who are not that tech-savvy,and traditional banks. In comparison, there is a lack of visibility of digital banks in customers’ daily lives apart from their marketing campaigns. The above analysis suggests that pure-play digital banks should actively foster trust between them and customers, particularly the elderly, through various means such that users are more confident about the banks’ capabilities.

There are downtimes for technologies, and even banks are not spared by technological breakdowns. For instance, the digital services of DBS Bank suffered two outages in just 16 months. During each incident, users were unable to access online banking platforms such as PayLah! E-wallet and DBS digibank, causing much inconvenience and outrage among bank customers, especially those who have to transact urgently. During the most recent incident on 29 March 2023, DBS had to extend the opening hours of all DBS and POSB branches by two hours so that customers can continue to transact using their physical DBS/POSB cards through ATM machines. As can be seen, during technological disruptions, DBS still has its physical bank branches and ATM machines to fall back on and customers can still perform bank transactions, though it may be a hassle for some. While certain digital banks such as Trust Bank have a physical centre that users can visit, it only serves as an Experience Centre and is unable to function as a bank branch and aid users in carrying out account-specific activities and address transactional disputes. In the event that users need to seek help, they can only do so by utilising in-app chat or to call them. Thus since full-fledged digital banks do not have physical branches or ATM machines, users may be denied of conducting any bank transactions should there be an outage of digital banking services.

To mitigate this, digital banks may consider partnering with physical retail stores if they want to offer users means to transact physically during outages and yet save on physical branches and ATMs. On that note, Singapore’s digital banks can look to Kakao Bank, Korea’s first profitable and listed virtual bank for insights. While Kakao Bank has no physical branches, it has established partnerships with convenience stores such a 7-11 to act as transaction outlets for it customerss. With that, Kakao bank account holders can withdraw cash at ATMs in the 24/7 convenience stores. Not only does this allow Kakao Bank to serve customers who are still demading cash withdrawal and deposit services, such partnerships is estimated to be able to bring down costs by as much as 30% according to industry experts.

In conclusion, despite the benefits afforded by digital banks, an overall shift in mindset is required before these online services fully penetrate the banking market. For digital banks to remain competitive amidst a field of traditional lenders, creativity must be employed to draw in and retain users in longer-term relationships – an effort that may prove to be the defining factor in establishing digital banks as the dominant force in banking.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of the National University of Singapore (NUS) or the NUS FinTech Lab.