We’d like to express our heartfelt gratitude and special thanks to Lauren Weymouth, Eric van Miltenburg, Ken Weber, and the entire Ripple team for the wonderful opportunity to present our NUS FinTech Lab projects at #UBRIConnect2024, held at the University of Zurich from September 9-11. It was an invaluable experience to engage with global academia and researchers, and we greatly appreciate the hospitality and support from the UBRI community.

Here are the key highlights of the projects we showcased:

1. NUSwap – Simulated Trading Platform with Live Market Data: Prof. Jungpil Hahn outlined the need for such a platform, while Valencia Lim, lab interns and Reshma Balaraman, research associates showcased its key features and shared insights from recent trading experiments with Morgan State University and FGV – Fundação Getulio Vargas.

The session provided valuable insights into data analytics and future research applications to shape the fintech landscape. Planned studies will focus on behavioral analysis, longitudinal trends, and the influence of real-world events on trading behaviors. It also emphasized potential collaborations with universities and industries for customized experiments.

The session concluded with pedagogy insights from George Micheni and Ali Emdad and Jéfferson A. Colombo, along with messages and recorded video shared by the top three contest winners.

2. Fractionate Real Estate Tokenization Platform: Presented by Hong Sheng Loy Sheng (lab intern), this project addresses key industry challenges by leveraging blockchain technology to streamline real estate registration. Fractionate enables fractional ownership, lowering the barriers to real estate investment for smaller investors and democratizing access to the property market. The platform also features a decentralized trading system that increases liquidity and flexibility, allowing seamless buying and selling of property tokens, and making real estate investments more accessible and fluid.

3. Verifin – Securing Blockchain Transactions: Presented by Songyue Wang (lab intern), Verifin enhances the security of blockchain transactions by introducing recipient identity auto-validation. As more companies adopt public blockchains for cross-border payments, Verifin tackles risks such as phishing and address poisoning by integrating a layer of identity validation through smart contracts. Built on the XRPL-EVM sidechain, the platform uses advanced technologies like Merkle Trees and PKI to securely verify recipient identities, making blockchain payments safer for B2B and B2C transactions.

The connections and insights we gained at UBRI Connect have further fueled our excitement about the future of fintech, AI, blockchain, security, and financial inclusion. We look forward to pushing boundaries and driving impactful change with our global partners!

#NUS #AI #FinTech #Blockchain #UBRIConnect2024 #Tokenization #AlgorithmicTrading #FutureOfFinance #Collaboration #Ripple #Technology #innovation #FinancialInclusion

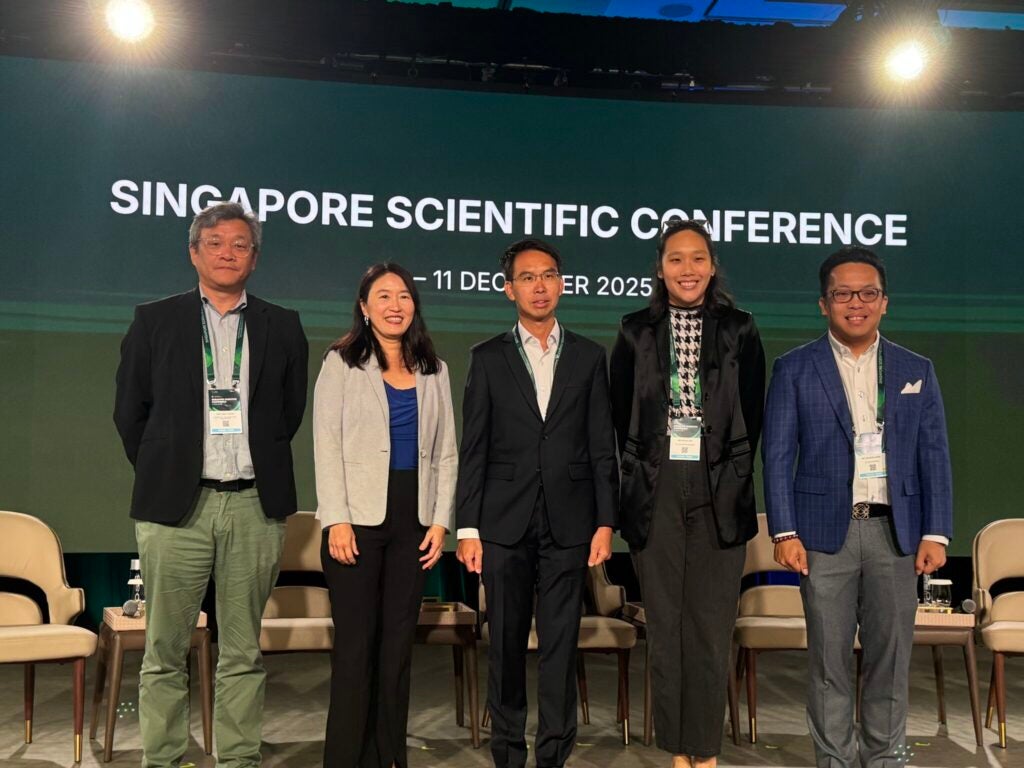

Gallery