Overview

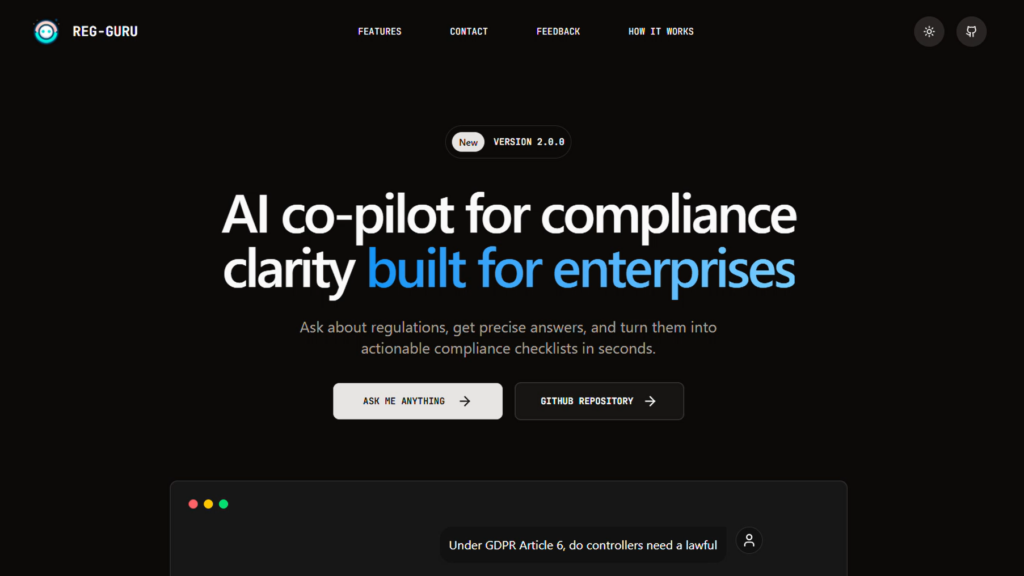

Compliance is a critical requirement in the financial sector, yet meeting regulatory obligations is often resource-intensive and complex. Reg-Guru is a lightweight retrieval-augmented generation (RAG)–powered compliance assistant built to make financial regulations easier to navigate. It provides contextual answers in real time based on collections of regulatory documents. Teams and individuals in banking and finance can use it to clarify requirements, reduce uncertainty, and save effort. It works in multi-languages and multi-jurisdictions. For start-ups, Reg-Guru offers tailored compliance checklists that simplify early planning. Subscribers also receive timely notifications on regulatory updates, keeping them informed as rules evolve.

Key Features

Document Collection

Reg-Guru maintains a public collection of regulatory documents and updates it regularly. All the documents are parsed and indexed automatically for better information retrieval.

Context-Aware Response

Based on the relevant information in the document collection, Reg-Guru provides more accurate responses compared to a pure generative language model. It supports multi-jurisdictional queries with ease.

Key Milestones

Demo

We invite teams, institutions and companies to join in using, evaluating, and improving Reg-Guru, especially for real-world compliance cases. If you are interested in this project, please email us at fintech@comp.nus.edu.sg. We look forward to an open discussion with you.