Summary

Ever wonder how our newest Web3 technologies could value-add to, or even transform, the music industry? Read on to discover how non-fungible tokens (NFTs) and blockchain technology could help reinforce music copyrights, enhance fan reward schemes, and improve identification techniques to reduce concert ticket scalping.

Have you ever pondered about the difference between Taylor Swift’s 2013 release of the 1989 album, and 1989 (Taylor’s version) that was out ten years later? Her project to re-record her older albums dated back in 2021, when she switched labels after her 13-year contract with Big Machine Records expired in 2018. However, the Big Machine contract, like numerous other artiste arrangements, proclaimed the label’s ownership over the recordings of her first six albums. This meant Swift had limited agency over the rights and revenue streams from her own music, and re-recording her older albums after leaving could help her claim full ownership over these copyrights.

Unfortunately, some passionate musicians enter the scene without being fully aware of the legal and financial complications in the industry. Or even if they are, the power dynamics between labels and artists meant that most contracts are in favour of record companies and music agents. This makes them vulnerable to exploitations by unfavourable contract terms, especially when it comes to copyrights.

Apart from copyright issues, concert ticket scalping has also stirred worry from fans for years – just look at the headlines on Carousell scams for Taylor’s Eras Tour tickets recently! Can our newest Web3 technologies, blockchain and NFTs, help improve these luring problems in the music industry?

NFTs in Music Copyrights

Non-fungible tokens, or NFTs, are unique, non-replicable digital assets that represent proofs of ownership over items that are mostly scarce, rare, and transferable, like digital art, music, video-game and metaverse collectibles, and even memes. These tokens are typically built on blockchain platforms – decentralised digital ledger systems for recording transactions across computer networks – like Ethereum and Flow.

Music copyrights generate royalties based on how often a song was played on various platforms or used for other productions. Under a 70/30 revenue split, 70% of this revenue is distributed to rights holders like publishers, songwriters, artists and record labels, and 30% to Spotify.

Under a traditional recording contract, the label gives artists cash advances to record their albums, but in return claims part of their music’s copyrights to take a share of royalty revenues. How much of that 70% of Spotify streaming revenue artists could get depends on how big of the pie their labels take – on average, artists could only earn $0.004 per Spotify stream, limiting their autonomy over their own music.

With NFT innovations, the artist previously receiving $4000 with a million Spotify streams ($0.004 x 1 million) could earn the same amount if there were 100 purchases for his music NFT priced at $40! Musicians retain ownership of the music copyright, which means they could fully decide where their music is and how their music is listened to. All they have to give up is a share of royalties, which is fractionalized as NFT for holders to receive regular payouts proportional to their share of rights to their crypto wallets whenever the song is streamed or used. This way, artists could tap into fan funding through sales of NFT copyrights without the need to compromise on their music ownership and withstand unfavaourable royalty revenue splits with record labels. It is also much less resource-intensive and time-consuming than re-recording music works, yet achieving the same goal of safeguarding artists’ copyrights.

Moreover, these music copyright NFTs are easily transferable, enabling collectors to trade them on company websites or NFT marketplaces like Opensea. This adds liquidity to the music NFT market to create a more dynamic ecosystem for music distribution and ownership.

Companies like Royal and Anotherblock have emerged, tokenizing royalties derived from the streaming by songs’ master recordings. Collaborating with artists like The Weeknd, R3hab, The Chainsmokers and Rihanna, these platforms not only facilitate closer connections between musicians and fans, but also help democratise music by shifting music ownership from large companies to individual artists.

NFT Fan Rewards & Concert Tickets

What’s even better about NFTs is their malleability to fit other products launched by artists, like exclusive merchandise and virtual experiences, for fans to own, use and trade. This application could come in handy for artist teams to craft innovative fan rewards and engagement campaigns to help attract new fans and enhance die hard fans’ loyalty. With NFT token gating, which grants access to specific content for owners of particular NFTs, these rewards can also be made exclusive to those who are active in NFT royalty campaigns, creating a circular ecosystem between both NFT applications.

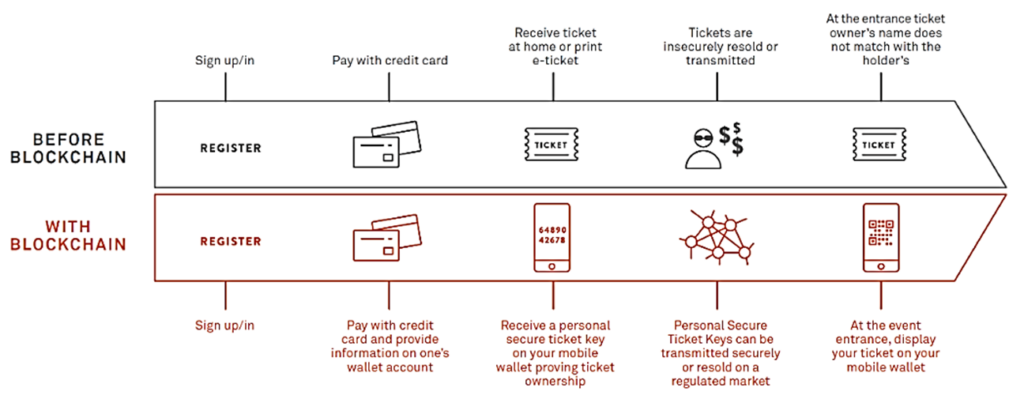

NFT concert tickets offer something more extraordinary than being a creative gimmick – they could even help greatly reduce scalping and fraud in ticket sales! Even if scalpers make “copycat” tickets with the same names and images, it’s impossible for them to fabricate the unique token verified backend on blockchain. With the transparency of blockchain records, one can just check the provenance of the attached NFT token to verify the legitimacy of the concert tickets before making a purchase in secondary markets. Even Coachella has levelled up its game to launch NFT-backed lifetime passes!

No Perfect Solution

We have witnessed the global hype surrounding NFTs, but scepticism also looms large. Copyright laws specific to NFTs and the metaverse space are not well-defined, making legal loopholes prominent – particularly threats of misuse and copyright infringement of NFT owners’ intellectual property. This requires collaborative efforts from regulatory bodies to devise a coherent set of legal guidelines in the coming years.

Scams are prominent in the NFT world too, but security measures for NFTs are still under development. Doing thorough research and verifying the authenticity of projects before investing may help, but it will inevitably jeopardise support for NFTs and undermine fan campaigns. With the prominent development of machine learning and artificial intelligence, we could foresee AI-powered security detecting and monitoring tools being helpful in filling these security gaps.

While it may not be the most opportune time for artists to implement NFT-powered schemes right now, its underlying blockchain technology has the potential to create impact at a larger scale. There is surely much potential, albeit challenges, in Web3 technologies to add value to the music industry in the near future.

References Links:

https://theridge.sg/2023/12/19/swiftonomics-the-economics-behind-the-eras-tour/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4640796

https://cointelegraph.com/learn/a-beginners-guide-on-the-legal-risks-and-issues-around-nfts

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of the National University of Singapore (NUS) or the NUS FinTech Lab.