Summary

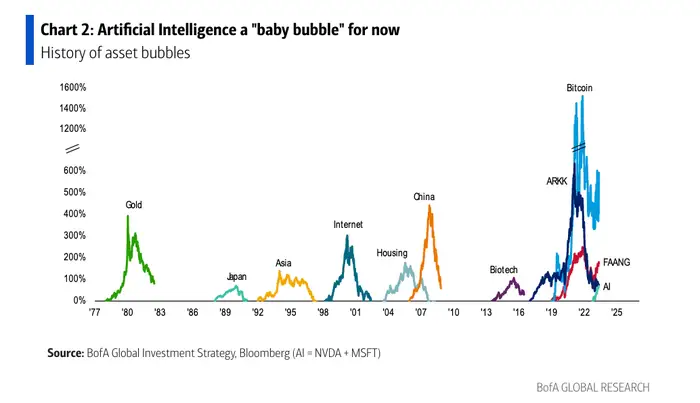

The recent AI surge has driven markets to new highs, with companies like NVIDIA leading the way. However, after AI stock prices dropped in July and August, many are questioning whether an AI bubble is forming. While this could be a temporary market reaction, the hype surrounding AI may resemble a bubble—though less severe than the Dot Com bubble. AI stocks appear overvalued, and the industry needs more revenue to sustain itself, with investors potentially overestimating the value of rapidly advancing semiconductor chips.

Read on to explore an analysis of the current situation, along with a comparison to the Dot-Com bubble at the turn of the millennium.

Introduction

The presence of Artificial Intelligence (AI) infiltrates numerous aspects of our lives, from code debugging for university students to smart medical diagnosis at hospitals. Riding on the AI wave, tech affiliated companies started witnessing exponential increases in their valuations and stock prices, driving markets to new heights. Notably, the Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla) recorded gains ranging from 50% to 240% in 2023 and accounted for over 60% of the S&P 500’s growth over 2024.

However, the prices of several AI stocks started falling in July and August, along with the broader stock market. Are these AI stocks steering the market to a bubble that will eventually bust, just like the Dot-Com bubble back in 2000?

A stock market bubble is when stock prices climb so rapidly that they far exceed the companies’ intrinsic value or earnings. Overly optimistic stock valuations, waves of bullish optimism and fear-of-missing-out (FOMO) sentiments among investors, and a disconnect between stock market growth and economic growth are some of the key features of bubbles.

Expansionary monetary policies like quantitative easing and low interest rates, changing economic and societal needs and technological innovations can all contribute to the formation of a bubble. When the bubble bursts, stock prices begin to drop, leading to panic selling and sometimes even a stock market crash.

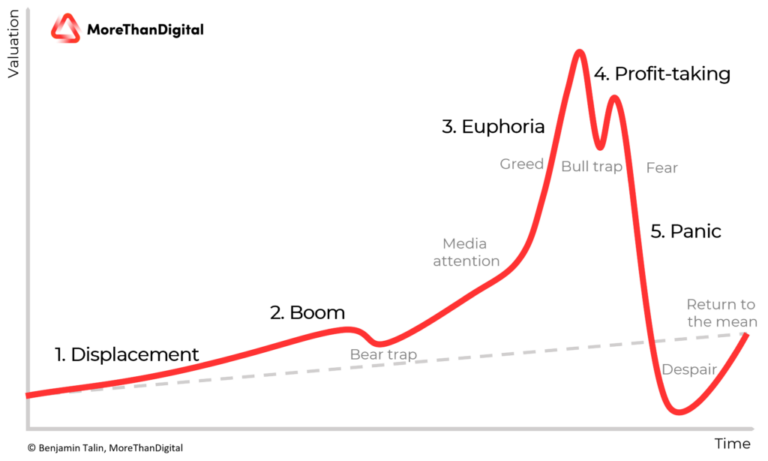

This chart illustrates the typical progression of asset prices throughout a bubble, largely following the market bubble mechanism mentioned earlier. With NVIDIA and Microsoft stocks serving as proxies for AI stocks, the asset price trends appear to be in the boom-to-euphoria stage as of mid 2023.

AI boom may be a bubble

It has been almost two years since Chat GPT’s release and we have seen a huge deal of potential and benefits reaped from generative AI. Tech stock prices skyrocketed ever since – the poster child, AI chip supplier NVIDIA’s stock price soared from $16 USD per share on Chat GPT’s launch date to a stunning peak of $131 USD, reaching a record valuation of over $3 trillion.

Shortly after reaching its 2024 high, NVIDIA lost 30% of its valuation (a trillion dollars!), and its stock prices plunged by 20%. Similarly, the Magnificent 7’s stock prices started witnessing declines starting July 2024 in response to disappointing second-quarter business results, with Microsoft falling by 14%, Amazon by 17%, and Tesla by 23%. This raises a prominent concern that investments in AI entailed ballooning costs with only modest gains, far different from the fairytale of incredible profits that was promised.

David Cahn, a partner of Sequoia Capital, noted that the AI industry needed to generate $600 billion annual revenue to sustain itself. This figure was only at $200 billion in September 2023. With Open AI taking the lion’s share of revenue at $3.4B, the revenue gap between the firm and other players still looms large. AI companies would definitely need to deliver products with significant value to justify their valuations – not simply softwares with GPT plug-ins.

The rapid pace of technological advancements in the semiconductor industry means that older chips quickly lose their value as chip-makers like NVIDIA keep on producing better next-generation chips such as the B100. As a result, investors may be overestimating the value that current chips hold in the near future. We may have been overly bearish on the AI hardware industry, unless we have reached a ceiling in semiconductor technology, or the surge in demand for AI chips counteracts this depreciation effect.

AI bubble won’t be as bad as the Dot-Com bubble

These all seem to replicate the boom and bust of the Dot-Com era. During the honeymoon phase of the Dot-Com bubble, valuations of Internet-based companies like Pets.com skyrocketed, and the NASDAQ Composite Index grew from under 500 in 1995 to a peak of 5000 in 2000. When the Federal Reserve started raising interest rates to curb inflation in early 2000, it made borrowing more expensive and reduced investment capital. The bubble burst: investors started a panic sell-off of dot-com stocks, nearly all of NASDAQ’s gain was erased, and most of these stocks failed by 2001, with some of them like Pets.com and eToys.com declaring bankruptcy.

However over-valued the Magnificent Seven seem, their valuations are actually much lower than the valuations of Internet stocks during the Dot-com bubble’s peak. The forward price-to-earnings ratio (current share price divided by forecasted earnings per share) of the NASDAQ 100 was 60.1x in March 2000 but only 26.4x in November 2023. This is not to say that all AI firms have viable business plans – some startups, like Character.ai and Humane Inc., have raised substantial funds despite lacking a product. During the Dot-Com era, many companies that venture capitalists funded had shaky fundamentals, but they were less fortunate in that there weren’t well-established firms with a history of profit-making leading the charge in the market. With the Magnificent Seven acting as strong pillars of the AI market, the industry is at least underpinned by more solid fundamentals, suggesting that the current AI enthusiasm may not be as sentiment-driven as the Dot-Com hype.

Investors nowadays are also more cautious and well-informed about the downsides of our current technology, like hallucination (generating misleading results), security risks, and job losses, just to list a few. With more transparency and information flow, the investor base probably won’t be as sentiment-driven as those back in the Dot-Com era.

Conclusion

Even the AI hype may appear to be a bubble, though not as extreme as the Dot-Com bubble, black-swan events like economic and political risks may bring surprises. Following a disappointing US jobs report in August, many economists are warning of an increased likelihood of recession soon, with Goldman Sachs estimating a 12-month recession risk between 15% and 25%. This means tampered business sentiments, which could potentially slow investments in the AI sector. Also, heightened geopolitical tensions may resort to an AI-arms race or bans on certain AI products, adding much more uncertainty to the AI market as well.

As individual investors, the best strategy to navigate the ever-changing market is to stay cautious, be in touch with new tech trends and economic happenings, and avoid making overly risky investments driven by FOMO.

Note

The launch of DeepSeek, a Generative AI model developed at a fraction of the cost of Chat GPT and other Large Language Models, has sent stock prices of the Magnificent 7 plummeting at the end of January. It wiped off a record one-day loss of USD 593 billion of NVIDIA’s market value on January 27.

However, this was not an indication of the AI bubble bursting, but rather an immediate market reaction. In fact, the stock prices of NVIDIA have largely recovered in the following weeks, buoyed by better-than-expected earnings. Nonetheless, this DeepSeek event echoes the narrative from last August, that we may have been overly bullish on AI. This could potentially change the market’s perception of AI development being a costly endeavor — a belief that has driven massive inflows of investments into the sector.

The reality is that much of this investment may be based on inflated expectations. If AI can be developed at a fraction of the cost, the high valuations of stocks in this sector may not be sustainable. The market’s optimism leads to over valuations that, in the long run, may not hold up.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of the National University of Singapore (NUS) or the NUS FinTech Lab.