Summary

Despite its reputation as a global financial hub, Singapore’s cryptocurrency market faces a significant regulatory shift. This article explores why MAS’s new regulations aim to protect consumers, the unique position of Singapore’s crypto landscape compared to Hong Kong and the UK, and the potential long-term impacts on innovation and market stability.

The intensification of cryptocurrency regulations by the Monetary Authority of Singapore (MAS) in 2023 marks a significant shift in the financial landscape, raising key considerations for the public: Why should this matter to them? Guided by Ravi Menon, MAS’s Managing Director, under the principle “Yes to Digital Asset Innovation, No to Cryptocurrency Speculation,” this regulatory shift is aimed at protecting consumers from industry risks, such as bankruptcies and unethical practices, to create a safer, more transparent trading environment. By prioritizing consumer protection, these regulations not only reduce risks but also aim to enhance the financial ecosystem’s stability, addressing concerns for anyone involved or interested in the cryptocurrency market.

The Pre-Regulatory Crypto Environment in Singapore

Before regulation, research by Henley & Partners rated Singapore as the top global crypto hub, with a score of 50.2 out of 60, a status attributed to the government’s forward-looking stance towards emerging technologies, including cryptocurrencies and blockchain. The MAS has been exploring blockchain and distributed ledger technology for financial transactions since 2016. With the Payment Services Act 2019, Singapore focused on consumer protection and anti-money laundering while providing a stable framework for cryptocurrency entities. This progressive environment, contrasted with more restrictive stances in other Asian countries, positioned Singapore as an attractive and innovative center for digital finance.

MAS’s Regulatory Strategy: Reasons and Immediate Impacts

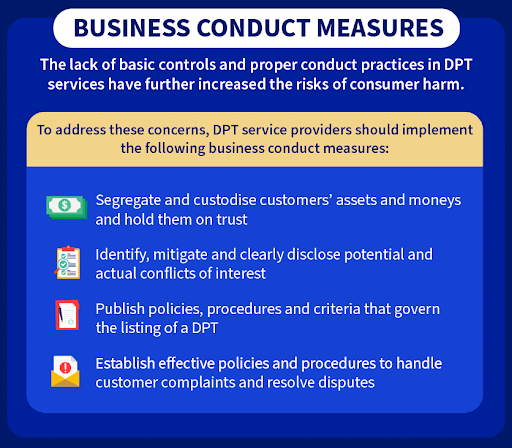

In July 2023, the MAS announced regulations for digital asset firms to ensure the security of customers’ funds, such as requiring firms to segregate customer assets and hold them under a statutory trust. This move was part of MAS’s commitment to “mitigate the risk of loss or misuse of customers’ assets,” enhancing customer fund security.

Source: MAS infographic

In November 2023, MAS further enhanced its strategy by prohibiting crypto entities from offering financing, margin transactions, or trading incentives, and restricting locally issued credit card payments. This move was primarily aimed at curbing speculative trading among retail customers.

Reflecting on the importance of these regulations, Ms. Ho Hern Shin, MAS’ Deputy Managing Director (Financial Supervision), emphasized, “DPT service providers have the obligation to safeguard the interests of consumers who interact with their platforms and use their services. While these business conduct and consumer access measures can help meet this objective, they cannot insulate customers from losses associated with the inherently speculative and highly risky nature of cryptocurrency trading. We urge consumers to remain vigilant and exercise utmost caution when dealing in DPT services, and to not deal with unregulated entities, including those based overseas”. These steps indicate MAS’s comprehensive approach towards consumer protection, covering aspects of business conduct, technology risks, and consumer access.

Long-Term Effects: Shaping the Future of Singapore’s Crypto Market

The long-term implications of these regulations are significant. By creating a more secure and transparent trading environment, MAS aims to reduce market volatility and increase investor confidence. This could lead to a more mature crypto market in Singapore, attracting institutional investors and encouraging fintech innovation. Additionally, these regulations may set a precedent for other nations, influencing global cryptocurrency policies and practices. A well-regulated market could also deter illicit activities and foster more responsible investment behaviors, contributing to the overall stability of the global financial system.

Comparison against Hong Kong and UK: Singapore’s Unique Position

Financial Center | Regulatory Authority | Regulatory Approach |

Singapore | Monetary Authority of Singapore (MAS) | Structured licensing under Payment Services Act and Securities and Futures Act, updated AML controls, mandatory licensing for all crypto service providers. |

Hong Kong | Multiple authorities including Hong Kong Monetary Authority, Securities and Futures Commission, the Insurance Authority (IA) and the Mandatory Provident Fund Schemes Authority (MPFA) | Guidance rather than direct regulation, varied authority oversight, ongoing consultations for new laws that might restrict crypto services to professional investors. |

UK | Financial Conduct Authority (FCA) | Prohibits the sale, marketing, and distribution of cryptocurrency-based investment products to retail customers; implements stringent identity verification requirements for crypto transactions (KYC). |

Singapore’s proactive and balanced regulatory stance contrasts with other financial centers. Unlike Hong Kong, which aims for a balanced approach between fostering innovation and protecting investors in its crypto regulation, Singapore has adopted a proactive stance. When compared with the UK, known for its stringent regulatory measures, Singapore’s approach appears to strike a balance, aiming to protect investors without stifling innovation. This strategic approach not only fortifies Singapore’s market but also sets a potential model for global crypto regulation.

The MAS’s 2023 regulatory adjustments represent a significant advancement in safeguarding Singapore’s cryptocurrency market. As we move forward, I anticipate that MAS will continue refining its regulatory framework to align with the rapid advancements in Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs). This strategic adaptability is essential to ensure that investor protection evolves alongside technological innovation, reinforcing Singapore’s position as a leading, adaptable financial hub in the face of digital transformation.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of the National University of Singapore (NUS) or the NUS FinTech Lab.