A heartfelt thank you to everyone who made Lab Crawl 2024 a success!

We’re grateful to our panel speakers, Thorsten Neumann (龚拓思), Tech Lead at SC Ventures by Standard Chartered, and Victor Ng, Adjunct Lecturer at NUS Computing, for sharing their invaluable insights during our Lab Crawl 2024. Special thanks to Dr. Nicholas MacGregor Garcia, Co-Director of NUS FinTech Lab, for kicking off the plenary session with a short introduction to NUS FinTech Lab and NUS Fintech Society and for moderating the panel session.

We’re also proud to celebrate the innovative spirit of our students, who showcased their projects that highlight the potential of fintech and technology. Key projects included:

1. NUSwap – A simulated trading platform by Valencia Lim

2. Large Value Payment System Simulation – By Kenneth See, FCCA

3. DeepShield – Countering deepfake technology, by Xuyan Zhou

4. Fractionate Real Estate Tokenization – By Hong Sheng Loy & Low Jian Cheng

5. Lenor AI Financial Literacy – By Harry W.

6. Ordinal Synthetic Market Bridge ERC20 – By Wei Rong

7. Verifin – Securing blockchain transactions with recipient identity, by Songyue (Songyue Wang, represented by Xuyan Zhou)

The session brought valuable insights into the current challenges, risks, and opportunities shaping fintech:

1. Tokenization Redefines Money

– Tokenization is reshaping money by introducing new assets and transactions, pushing fintech to innovate beyond traditional models and focus on real value creation for lasting impact.

2. Strategic Partnerships for Resilient Growth

– Fintech’s reliance on venture capital creates funding cycles; strategic alliances with traditional finance provide stability, supporting sustainable growth and long-term customer relationships.

3. AI-Enhanced KYC for Better Client Experience

– Fragmented KYC processes impact client experience, but fintechs are using AI and data integration to streamline compliance, risk scoring, and create more seamless, customer-centered services.

4. AI as a Solution to Legacy Constraints

– While banks are hindered by legacy systems, fintechs can build modern infrastructures and use AI to drive scalable, agile solutions, leading the way in industry modernization.

5. Preparing Future Leaders with Practical Skills

– Academic programs focus on hands-on experience and critical thinking to prepare students for real-world fintech challenges, equipping them to drive innovation in digital finance.

We extend our gratitude to all the overseas guests, and delegates who joined us to explore these innovative projects and look forward to future collaborations that will continue to propel fintech innovation forward.

#NUS #SFF2024 #Innovation #LabCrawl2024 #Fintech #Blockchain#AI

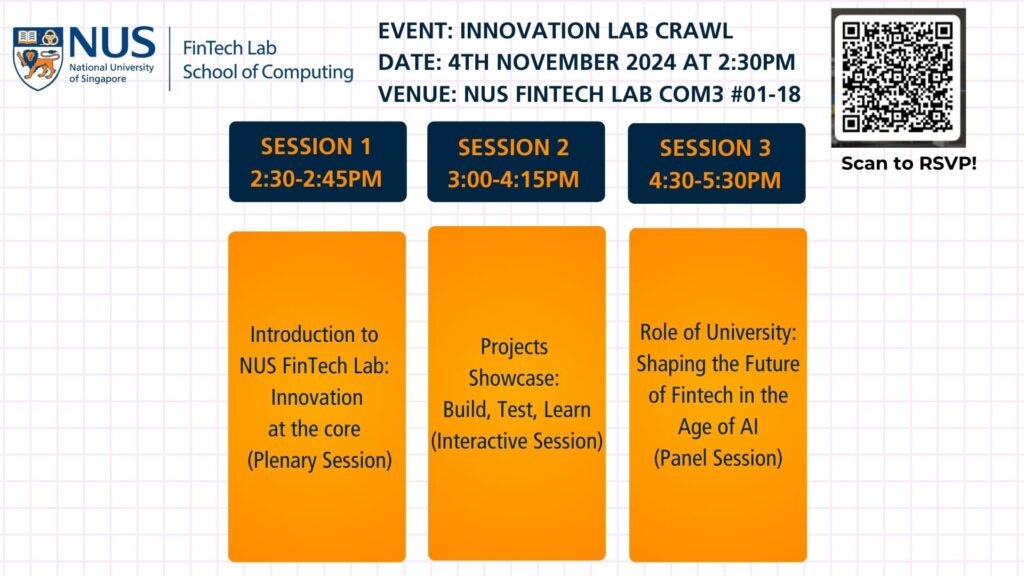

NUS FinTech Lab Innovation Lab Crawl 2024