Summary

On 21 February 2025, Bybit cryptocurrency exchange suffered a record-breaking $1.5 billion Ethereum theft through sophisticated social engineering and manipulation of multi-signature smart contract logic. The incident highlights critical security vulnerabilities, underscoring the need for advanced authentication solutions, enhanced employee training, regulatory oversight, and cautious investor practices.

On February 21, 2025, Bybit, a prominent cryptocurrency exchange, experienced a significant security breach, resulting in the theft of approximately $1.5 billion in digital assets, primarily Ethereum. This breach stands as the largest cryptocurrency heist to date, surpassing previous high-profile hacks and sending shockwaves throughout the crypto industry. The incident raises several important questions: How did it happen? Who was behind it? What does this mean for the future of crypto security?

How the Attack Unfolded

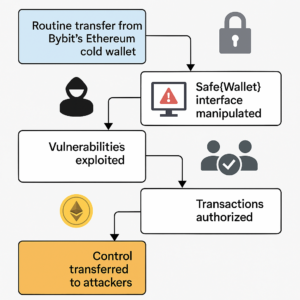

The breach occurred during a routine transfer from Bybit’s Ethereum cold wallet— a storage method where private keys are kept offline to enhance security—to a warm wallet. This process is used to move funds into more accessible wallets for operational use. Hackers exploited vulnerabilities in the transaction approval process by manipulating the Safe{Wallet} interface, a widely used multi-signature wallet solution that typically requires multiple approvals to authorize transactions and is generally considered highly secure. They injected malicious code into the web interface, deceiving wallet signers into authorizing transactions that secretly altered the smart contract logic, ultimately transferring control of the wallet to the attackers.

Subsequent investigations attributed the attack to the Lazarus Group, a North Korean cybercriminal organisation. The U.S. Federal Bureau of Investigation (FBI) confirmed North Korea’s involvement, referring to the malicious cyber activity as “TraderTraitor”. The Lazarus group was previously linked to the 2022 Ronin Network hack, which resulted in a $620 million loss in Ethereum. In 2024 alone, North Korean-affiliated groups were responsible for stealing approximately $1.34 billion across 47 incidents, a significant increase from the $660.5 million stolen in 20 incidents in 2023.

Implications for Crypto Regulation and Security Standards

The scale of the Bybit hack is likely to influence global cryptocurrency regulations and security practices:

- Stricter Regulatory Oversight: Regulators worldwide may impose more stringent requirements on cryptocurrency exchanges, including mandatory security protocols and regular compliance audits, to protect investors and maintain market integrity.

- Political Impact on Deregulation Efforts: The hack raises questions about the feasibility of crypto deregulation, particularly in the U.S., where current President Donald Trump has recently expressed support for digital assets. While deregulation aims to boost innovation and market expansion, large-scale hacks like this may force policymakers to reconsider the risks of lax oversight, potentially contradicting pro-deregulation efforts.

- Reevaluation of Multi-Signature Authentication: Given the vulnerabilities exposed in this attack, there may be a push for more advanced authentication mechanisms beyond traditional multi-signature setups, incorporating technologies such as threshold signatures and hardware security modules.

Market Impact: Will Hacks Cause Crypto Devaluation?

Major hacks often contribute to sharp declines in cryptocurrency prices. Following the Bybit incident, Bitcoin’s value fell below $90,000, marking a 20% drop from its January peak, while Ethereum experienced a 24% decline. However, broader market trends, regulatory developments, and macroeconomic factors may also have influenced these price movements. The demand for blockchain technology, institutional investments, and ongoing innovation often mitigate long-term damage, preventing permanent devaluation of assets like Ethereum and Bitcoin.

Balancing Cybersecurity and Innovation

In response to cybersecurity risks, several key initiatives have already been implemented to enhance security without hindering innovation:

- Collaborative Security Frameworks: Establishing industry-wide standards and sharing threat intelligence can help preempt and mitigate attacks. By promoting shared standards and real-time threat intelligence, platforms can better identify vulnerabilities and respond to emerging risks. For example, initiatives like the Crypto Information Sharing and Analysis Center (CISAC) allow members to exchange critical cybersecurity insights.

- Incentivising Security Research: Encouraging independent security research through bug bounty programmes can lead to the early discovery of vulnerabilities. Platforms such as Immunefi facilitate these efforts by connecting ethical hackers with crypto projects.

- Adaptive Regulatory Approaches: Regulations should be flexible enough to adapt to the rapidly evolving crypto landscape, ensuring they protect users without imposing undue constraints on technological progress. For example, the Monetary Authority of Singapore (MAS) has implemented the Technology Risk Management (TRM) Guidelines, which provide a comprehensive framework for financial institutions, to manage technology and cybersecurity risks. These guidelines require Digital Payment Token (DPT) service providers to establish secure technology infrastructure, develop business continuity and disaster recovery plans, and conduct regular vulnerability assessments.

The Bybit hack serves as a pivotal moment for the cryptocurrency industry, exposing critical security gaps that must be addressed to prevent future billion-dollar breaches. Crypto exchanges must adopt stronger authentication methods, enhance employee training against social engineering attacks, and regularly audit and update smart contracts. Additionally, fostering a collaborative industry-wide response through threat intelligence sharing is essential. Proactive measures and informed participation are vital to ensure the crypto industry’s resilience and sustained growth.

For investors, this incident serves as an important reminder of the substantial risks associated with cryptocurrency investments. They should remain vigilant against phishing attempts, use trusted platforms, diversify their holdings, and invest only what they can afford to lose.

Disclaimer: The views and opinions expressed in this article are solely those of the author and do not reflect the official policy or position of the National University of Singapore (NUS) or the NUS FinTech Lab.